Get involved

Your support means we can continue to provide vital activities and services which help local families; see how you can make a difference

The online Directory provides a comprehensive guide to useful contacts to point you in the right direction.

SNAP’s vision is to provide a safe environment offering a wide range of support and specialist services with the aim to increase resilience and empowerment within our families. SNAP’s ethos is about strengthening all members of the family.

There’s nothing too small or too large you can do to help SNAP; if you would like to support us, there’s lots of opportunity and we’d welcome your contribution.

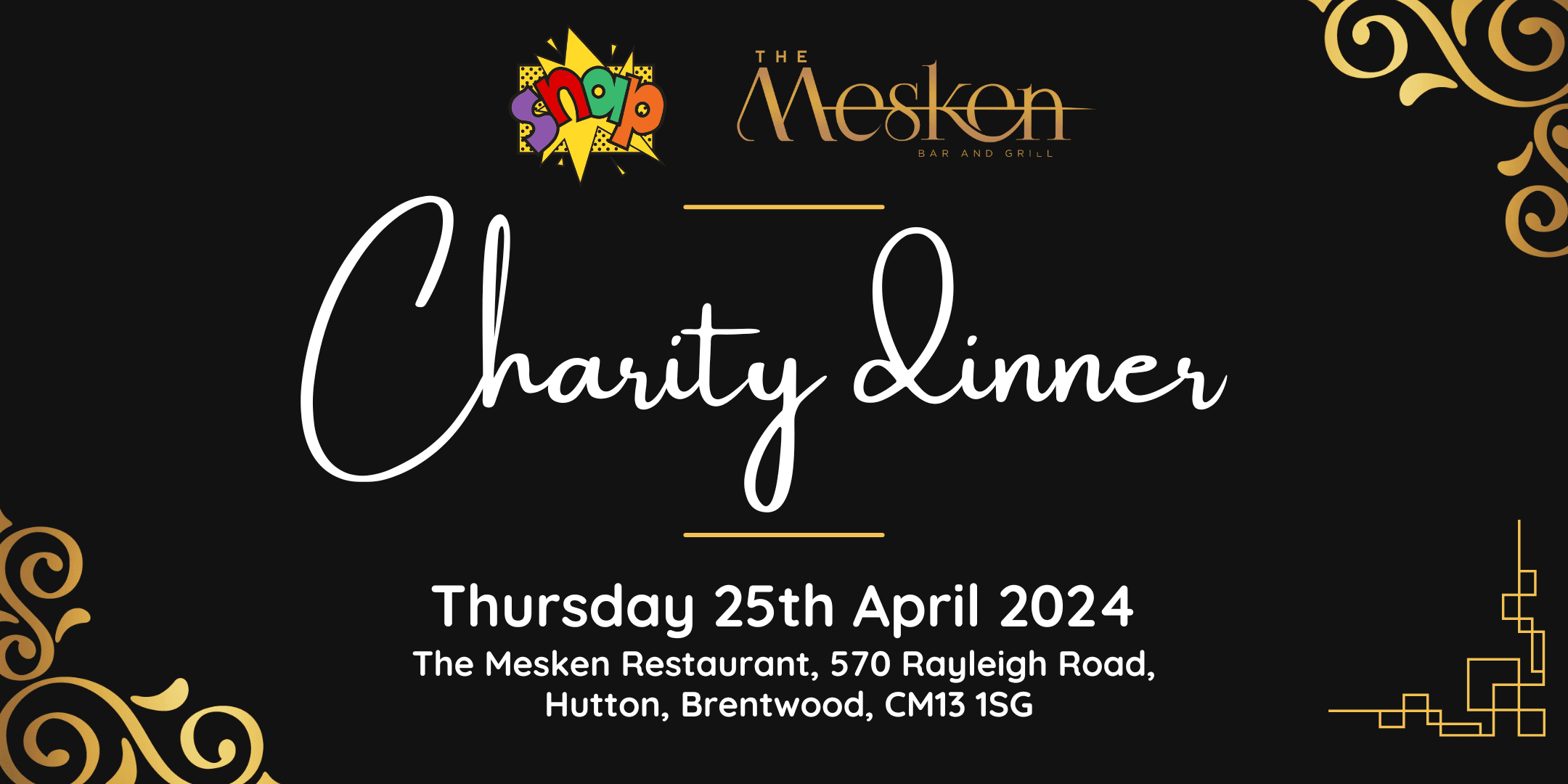

From our base in Brentwood, SNAP is an Essex charity which helps thousands of families with children and young people who have an additional need or disability.

Your support means we can continue to provide vital activities and services which help local families; see how you can make a difference

There are lots of different ways to get involved with SNAP including fundraising, raising awareness and volunteering. All of them can bring positive benefits to the individuals who give up their time and money too. SNAP cannot continue its essential work without our supporters. We recognise this support and appreciate it whether it is financial, or through your time in volunteering or fundraising on our behalf. We can keep you informed of the charity’s work and development for as long as you wish.

As registered members we aim to adhere to the Fundraising Promise and the Code of Fundraising Practice, ensuring our fundraising is;

SNAP has to raise more than £600,000 each year if it is to continue our current level of support. And of that figure, we need to receive around £390,000 this year in voluntary donations. Every little helps!

Our volunteers help us make us what we are – whether it’s helping out at our centre or supporting one of our many activities; it’s very rewarding for everyone involved

Request to receive Parent and Carer support

Help support The SNAP Centre and Services